Certain things tend to repeat themselves. Some are pleasant, like spring or holidays. Others, for instance utility bills and car payments, are more of a necessary evil.

Use the repeat option in the Toshl app to keep track of your reccurring expenses. You can set the interval so that the expenses repeat daily, weekly, monthly, or whenever you decide. Remember that adding extra information to either incomes or expenses is done in the same way. We will present an example for an expense, but you would edit an income following the same steps.

The option to repeat expenses, incomes and transfers automatically becomes available with Toshl Pro or Toshl Medici subscriptions.

Repeating entries are appropriate for use on financial accounts you otherwise track manually. Accounts that are connected to your bank, will add the entries automatically as they come in, so such repeating settings are not necessary there.

1. Selecting the Repeats tab

After adding the basic expense information, click “Show more” under the “Save” button to display the additional options.

The option to automatically repeat the entries is marked with an icon featuring the letter R in an arrowed circle.

2. Repeat options

2.1 Repeat intervals

The expense can be repeated:

- daily

- weekly

- monthly

- yearly

- on weekdays

- on weekends

- in a custom interval.

Click on the Repeat option and select a suitable interval from the menu.

The “Custom repeat” option allows you to set a repeat with an uncommon interval. For instance, you could use it to record your expense that would be paid in 10 instalments (partial payments) every other week. In that case you would set the custom repeat to 2 weeks, and end repeating after 10 times.

2.2 Ending the repeats

The repeats can go on forever until you stop them, stop after a certain date, or stop after a set number of repetitions. Select an option from the menu.

Selecting the repeating to stop after a certain date brings up a calendar.

The date picker functions in the same way as when you are selecting a date for your expense. That includes all the shortcuts, like clicking on a month label to bring up a quicker month selection …

… and clicking on the year label to display a year selection.

Date format can be adjusted in Settings, under the General tab. Check the Regional Settings tutorial for more information.

For a set number of repetitions simply enter a one or two digit number. The date of the final repeat will be displayed on the screen. Also, your first expense is included in the repeat count.

3. Automatic reminders

The weekly, monthly and yearly repeats, as well as the custom repeats (except custom daily repeats) will automatically set two reminders to notify you of an upcoming expense.

The first reminder is set on a day before the expense, and a second one on the day the expense is due. You can modify the reminders according to your needs, or cancel them altogether.

4. Managing repeating expenses

Entries that repeat automatically are marked with an “R” icon on your list of expenses. The set interval and a possible alert for the payment are included in their details.

4.1 Edit repeating expenses

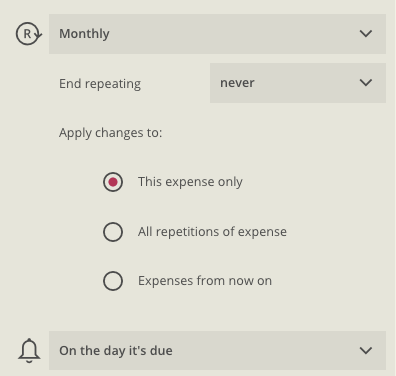

You are able to edit, duplicate or delete such expenses in the same way as all other entries. However, you do have to specify if you wish to apply changes to only the expense you are editing, to all the repetitions of this expense, or just the expenses that are planned for the future.

A dialogue with these options also appears whenever you attempt to delete an entry with a set reminder.

After a repeating expense has been created, it is not possible to edit the overall repeat setting – with the exception of setting it to “Never” and cancelling the repetitions. For example, if an expense was set to repeat on the 10th every month, it cannot be changed to repeat on the 15th, or for instance switched from a monthly to a weekly repeat.

The date can be edited only for an individual expense inside the repeat frame, but the repeating for the expense will continue the way it was set initially.

4.2 Cancel repeating expenses

To permanently change the pattern of a recurring expense, you have to stop the expense from repeating and enter a new one with new repeating dates.

There are two ways of ending an existing repeat:

- edit the repeating expense on the date from when you’d like it to stop, and change the repeat setting to “Never”,

or

- edit the repeating expense by adjusting the date for “Stop repeating after”. As the change affects the entire repetition it will automatically apply to “All repetitions of expense”.

When modifying or deleting the entries with repeats, make sure not to delete all the repetitions of an expense, if you wish to keep the past entries in your record of expenses.

5. Examples for using repeats

5.1 Example: salary – repeating income

The most clear-cut example of a repeating income is the monthly salary. Let’s record a regular income of 1400 €, in a category “Salary”, for the financial account “General”. The event will be repeated monthly on the 15th, with a reminder on the day it’s due.

That is all you have to do to have your income automatically recorded and repeated. Simple.

5.2 Example: subscriptions – repeating expense

Another good example for the use of repeats are the subscription services. Let’s check the recurring expenses for a media streaming subscription for 7.99 € on the 12th each month, file hosting for 9.99 € on the 10th, and, most importantly, a monthly delivery of socks for 12.02 € on the 21st. These amonts will be billed on the credit card (be careful when selecting the appropriate financial account).

We will record them all under a category “Subscriptions” to further simplify the overview of our expenses later on. This way, they will all be listed together in the main expenses’ list.

5.3 Example: repeated transfers into a savings account

Repeats can also come in handy when managing your savings account.

Open up a new transfer tab (click on the “All accounts” tab in the upper right corner and select “Add transfer” option), enter the amount as well as the “Source” and “Destination” accounts – in our case that’s “General” and “Savings”. Proceed with the date, an optional description, the repeat setting, and a reminder.

This way the Toshl app will remind you each month, on the 16th, that 300 € is waiting to be transfered from your general financial account into savings.

5.4 Example: paying off debt in instalments – repeating expense

Let’s say that you bought a 750 € custom paint job for your car, as one of those impulse purchases. No reason to worry, here’s how you can quickly split your expense into, for instance, 3 instalments with a custom repeat every 3 weeks, for a total of 3 repeats for 250 € each.

Other great examples to use repeats with your incomes and expenses in Toshl include tracking of utility bills, rent, taxes, insurance, and many more.

6. In conclusion

With such versatile options, why not take advantage of the repeating entry function and include it into your monitoring of personal finances. A brief moment to consider possible patterns in your financial flows now could save you loads of time later on.

For additional information and, perhaps, inspiration on how you might be able to use repeats with your financial tracking, follow this link to learn more about tracking of loans, repaying debt, and shady loansharks.

Related articles: