Considering all the responsibilities and information we have to juggle with every day, it’s no wonder that sometimes things slip our minds. Set reminders in your Toshl app to receive notifications about the expenses, incomes and transfers that will require your attention in the future, and keep those financial plans in check.

Setting up reminders with your incomes, expenses or transfers is done in the same way. We’ll review how to do it for an expense, but you would set up a reminder for other types of entries by following the same steps.

The option to set reminders becomes available with Toshl Pro or Toshl Medici subscriptions.

There’s no horsing around when it comes to unicorn expenses.

1. Selecting the Reminder feature

Let’s say that we have borrowed 50 € from a friend and we want to pay him back on April 6th. Because we have good manners, we will set ourselves a reminder, just to make sure that our debt gets paid on time.

After entering the amount, selecting a category and an account (we’ll pay cash) as well as the date, we click the “Show more” button on the bottom of the expense window to revel additional optional features.

2. Setting up reminders

Selecting the Reminder tab opens up the menu with options:

- 1 day before

- On the day it’s due

- Custom reminder

- Never

With first two selections the reminder is by default set for 11am, and a custom option allows for a more specific time period. With it you can set exactly how many days, weeks, months or years before the expense is due you wish to receive a reminder, and precisely at what time.

It is possible to save 5 different reminders for each entry, with all the options turned on at once.

3. Reminder notifications

Reminders are displayed in the “Monthly overview” page of your Toshl app.

Highlighting the notification brings up an option to mark the expense as paid.

Notifications can be turned ON/OFF altogether in Settings – Notifications. In the menu you can enable for the notifications to also arrive by email, for those instances when an in-app notification catches you at a bad time and you have to quickly dismiss it. This way you will always stay on track with the upcoming bills and incomes.

The in-app notifications are simultaneously triggered in the Toshl web app as well as on your mobile devices where you’re keeping Toshl installed.

4. Reviewing entries with reminders

The entries that include reminders will be diplayed on the overall list with a little bell icon.

The reminder information is also listed in the Expense details view. The setting itself can be edited at any time, in the same way as all the other specifications for your entries.

5. Reminders and repeats

Reminders are automatically set for most of the automatically repeating entries. The weekly, monthly and yearly repeats, as well as the custom repeats (except custom daily repeats) will automatically set two reminders to notify you of an upcoming expense:

- for 1 day before

- on the day the expense is due.

Such events are once again listed with the bell icon, and also with the “R” icon that signifies repeats.

6. Paid / Unpaid function

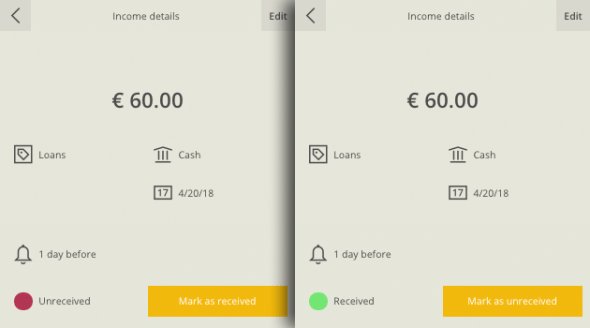

When a reminder is active for an expense that’s due to be paid, a red dot appears in the entry details tab. The dot turns green when you mark the expense as paid.

The paid / unpaid status is shown only for your reference and it does not affect account balances and others sums. All entries up to the current date get registered in balances of financial accounts, regardless of the expense’s status and whether it has already been paid or not.

With incomes, the function is marked as “Received / Unreceived”, but otherwise works in the same way.

7. Daily reminder

A daily reminder to enter expenses is an option, available in the general Settings menu.

Here you can set an exact time when you’d like to be reminded – gently – to record your expenses for the day.

Whether it is regular expenses like utility bills and subscription services, unplanned short-term loans, or monthly transfers into your savings account, it is always better to be prepared than taken by surprised.

Make good use of bill reminders in Toshl web app for an even better control over your personal finances.

Related articles:

Toshl monsters use reminders for that first morning cup of coffee. They never forget about the other 45 cups over the course of the day, either.

Your fresh financial year can now begin in earnest…

Your fresh financial year can now begin in earnest…